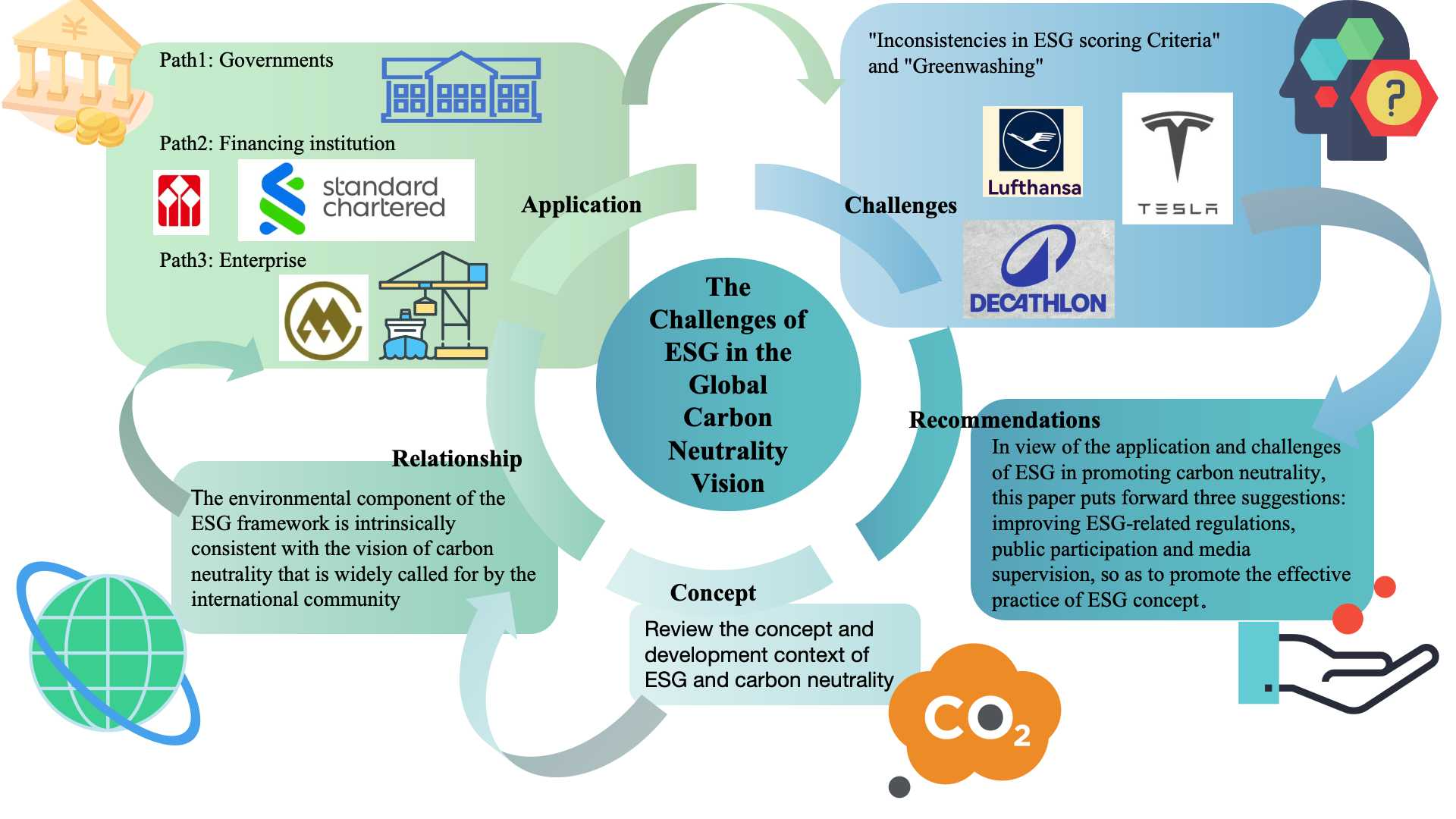

In the urgent context of global warming, this paper comprehensively examines the application and challenges of environmental, social, and governance (ESG) frameworks in achieving the global carbon neutrality vision. ESG, encompassing environmental, social, and governance factors, serves as a critical tool for evaluating the sustainable development performance of enterprises. ESG ratings provide essential data for research and strategic decision-making on ESG initiatives. Originating from socially responsible investment in the 1960s, the concept of ESG has evolved through four distinct stages: origin, development, establishment, and rapid development. This paper begins by outlining the concept of carbon neutrality, detailing its emergence, timeline, and current status. It then traces the evolution of ESG. Through an extensive review of literature and detailed case studies, this paper synthesizes existing research to offer actionable insights for stakeholders, reflecting on past practices, analyzing current applications, and forecasting future challenges and opportunities in the journey towards global carbon neutrality.

- Open Access

- Review

The Application and Challenges of Environment, Social and Governance in the Global Carbon Neutrality Vision

- Ruhan Ma 1, 2,

- Hengjia Jia 1,

- Gaotingyue Li 1, 3,

- Fanghua Li 1, 2, *

Author Information

Received: 11 Mar 2025 | Revised: 26 Mar 2025 | Accepted: 14 Apr 2025 | Published: 21 Apr 2025

Abstract

Graphical Abstract

Keywords

environment society and governance (ESG) | carbon neutrality | sustainability | green development

References

- 1.EWM. Health, Wealth and Population in the Early Days of the Industrial Revolution. Nature 1927, 119, 379–381.

- 2.Song, F.; Dong, H.; Wu, L.; Leung, L.R.; Lu, J.; Dong, L.; Zhou, T. Hot season gets hotter due to rainfall delay over tropical land in a warming climate. Nat. Commun. 2025, 16, 2188.

- 3.Musah, M.; Gyamfi, B.A.; Kwakwa, P.A.; Agozie, D.Q. Realizing the 2050 Paris climate agreement in West Africa: The role of finanscial inclusion and green investments. J. Environ. Manag. 2023, 340, 117911.

- 4.Zhao, R.; Huang, X.-J.; Yun, W.; Wu, K.; Chen, Y.; Wang, S.-J.; Lu, H.-L.; Fang, K.; Li, Y. Key issues in natural resource management under carbon emission peak and carbon neutrality targets. J. Nat. Resour. 2022, 37, 1123–1136.

- 5.Li, L.; Zhang, Y.; Zhou, T.; Wang, K.; Wang, C.; Wang, T.; Lü, G. Mitigation of China’s carbon neutrality to global warming. Nat. Commun. 2022, 13, 5315.

- 6.Wiese, F.; Taillard, N.; Balembois, E.; Best, B.; Bourgeois, S.; Campos, J.; Marignac, Y. The key role of sufficiency for low demand-based carbon neutrality and energy security across Europe. Nat. Commun. 2024, 15, 9043.

- 7.Van Soest, H.L.; den Elzen, M.G.J.; van Vuuren, D.P. Net-zero emission targets for major emitting countries consistent with the Paris Agreement. Nat. Commun. 2021, 12, 2140.

- 8.De Souza Barbosa, A.; da Silva MC, B.C.; da Silva, L.B.; Morioka, S.N.; de Souza, V.F. Integration of Environmental, Social, and Governance (ESG) criteria: Their impacts on corporate sustainability performance. Humanit. Soc. Sci. Commun. 2023, 10, 410.

- 9.Deng, J. Exploring the heterogeneous effects of environmental, social, and governance performance on idiosyncratic risk: Do political ties matter? Humanit. Soc. Sci. Commun. 2025, 12, 422.

- 10.Kammen, D.M.; Sunter, D.A. City-integrated renewable energy for urban sustainability. Science 2016, 352, 922–928. https://doi.org/10.1126/science.aad9302.

- 11.Jia, Z.; Lin, B. How to achieve the first step of the carbon-neutrality 2060 target in China: The coal substitution perspective. Energy 2021, 233, 121179.

- 12.Zhang, Z.; Hu, G.; Mu, X.; Kong, L. From low carbon to carbon neutrality: A bibliometric analysis of the status, evolution and development trend. J. Environ. Manag. 2022, 322, 116087.

- 13.Zhang, Q.; Liu, J.-F.; Gao, Z.-H.; Chen, S.-Y.; Liu, B.-Y. Review on the challenges and strategies in oil and gas industry’s transition towards carbon neutrality in China. Pet. Sci. 2023, 20, 3931–3944.

- 14.Teng, Q.; Zhang, Y.-F.; Jiang, H.-D.; Liang, Q.-M. Economy-wide assessment of achieving carbon neutrality in China’s power sector: A computable general equilibrium analysis. Renew. Energy 2023, 219, 119508.

- 15.Zhang, W.; Cuijing, J.; Liu, Z.; He, P.; Wuhao, E. Examining the impact of tourism on carbon neutrality and environmental sustainability in China: The role of renewable energy. Energy Strategy Rev. 2024, 56, 101579.

- 16.Yang, M.; Pan, H.; Ma, X.; Zhang, Y.; Lyu, Y.; Zhang, X.; Shui, W.; Yang, Z. Energy self-sufficiency and carbon neutrality potential of Chinese urban wastewater treatment. J. Clean. Prod. 2024, 475, 143657.

- 17.Liu, H.; Wang, J.; Liu, M. Can digital finance curb corporate ESG decoupling? Evidence from Shanghai and Shenzhen A-shares listed companies. Humanit. Soc. Sci. Commun. 2024, 11, 1613.

- 18.Shen, H.; Lin, H.; Han, W.; Wu, H. ESG in China: A review of practice and research, and future research avenues. China J. Account. Res. 2023, 16, 100325.

- 19.Zhao, J.; Tang, Y.; Zhu, X.; Zhu, J. National environmental monitoring and local enforcement strategies. Nat. Cities 2025, 2, 58–69.

- 20.Baldini, M.; Maso, L.D.; Liberatore, G.; Mazzi, F.; Terzani, S. Role of country- and firm-level determinants in environmental, social, and governance disclosure. J. Bus. Ethics 2018, 150, 79–98.

- 21.Lin, C.; Lu, S.; Su, X.; Wen, C. RETRACTED ARTICLE: Can the greening of the tax system improve enterprises’ ESG performance? Evid. China Econ. Chang. Restruct. 2024, 57, 127.

- 22.Jia, L.; Li, F. Carbon Dioxide and Nitrate Electrocatalytic C-N Coupling for Sustainable Production of Urea. Sci. Energy Environ. 2024, 1, 2.

- 23.Cao, M.; Duan, K.; Ibrahim, H. Green investments and their impact on ESG ratings: An evidence from China. Econ. Lett. 2023, 232, 111365.

- 24.Younis, O.; Xiao, X.; Yang, J.; Aly, K.I.; Bakhite, E.A.; Yang, X. Advancements in Luminescent Metal-Organic Cages: Applications and Future Prospects. Sci. Energy Environ. 2024, 1, 8.

- 25.Xiao, Y.; Xiao, L. The impact of artificial intelligence-driven ESG performance on sustainable development of central state-owned enterprises listed companies. Sci. Rep. 2025, 15, 8548.

- 26.Romolini, A.; Fissi, S.; Gori, E. Scoring CSR reporting in listed companies–Evidence from Italian best practices. Corp. Social. Responsib. Environ. Manag. 2014, 21, 65–81.

- 27.Zheng, Y.; Feng, Q. ESG performance, dual green innovation and corporate value—Based on empirical evidence of listed companies in China, Environment. Dev. Sustain. 2025, 27, 609–624.

- 28.Avramov, D.; Cheng, S.; Lioui, A.; Tarelli, A. Sustainable investing with ESG rating uncertainty. J. Financ. Econ. 2022, 145, 642–664.

- 29.Chai, H.R.; Cheng, Z.H.; Wu, W.X. Is ESG performance a protective umbrella for ESG violations? Int. Rev. Financ. Anal. 2025, 98, 103858.

- 30.Luo, D.Q.; Yan, J.Z.; Yan, Q.H. The duality of ESG: Impact of ratings and disagreement on stock crash risk in China. Financ. Res. Lett. 2023, 58, 104479.

- 31.Sahin, Ö.; Bax, K.; Czado, C.; Paterlini, S. Environmental, Social, Governance scores and the Missing pillar-Why does missing information matter? Corp. Social. Responsib. Environ. Manag. 2022, 29, 1782–1798.

- 32.Sahin, O.; Bax, K.; Paterlini, S.; Czado, C. The pitfalls of (non-definitive) Environmental, Social, and Governance scoring methodology. Glob. Financ. J. 2023, 56, 104479.

- 33.Shakil, M.H. Environmental, social and governance performance and financial risk: Moderating role of ESG controversies and board gender diversity. Resour. Policy 2021, 72, 102144.

- 34.Yang, R.F.; Caporin, M.; Jiménez-Martin, J.A. ESG risk exposure: A tale of two tails. Quant. Financ. 2024, 24, 827–849.

- 35.Zeng, Q.D.; Xu, Y.; Hao, M.S.; Gao, M.Q. ESG rating disagreement, volatility, and stock returns. Financ. Res. Lett. 2025, 72, 106602.

- 36.Dai, T. Delving into the green growth dilemma and ESG investing in Southeast Asia. Humanit. Soc. Sci. Commun. 2025, 12, 193.

- 37.Sun, W.; Luo, Y.; Yiu, S.-M.; Yu, L.; Ding, W. ESG scores, scandal probability, and event returns. Financ. Innov. 2024, 10, 121.

- 38.Dai, L.; Wang, J. The impact of ESG rating disagreement on corporate risk-taking: Evidence from China. Digit. Econ. Sustain. Dev. 2024, 2, 18.

- 39.Biju, A.V.N.; Kodiyatt, S.J.; Krishna, P.P.N.; Sreelekshmi, G. ESG sentiments and divergent ESG scores: Suggesting a framework for ESG rating. SN Bus. Econ. 2023, 3, 209.

How to Cite

Ma, R.; Jia, H.; Li, G.; Li, F. The Application and Challenges of Environment, Social and Governance in the Global Carbon Neutrality Vision. Science for Energy and Environment 2025, 2 (2), 5. https://doi.org/10.53941/see.2025.100005.

RIS

BibTex

Copyright & License

Copyright (c) 2025 by the authors.

This work is licensed under a Creative Commons Attribution 4.0 International License.

Contents

References